February 10, 2020

By Angus Ingram, Investment Manager, Kilter Rural

Recent bushfire events in Australia have thrust themselves onto the screens of the world depicting dramatic images of holiday makers seeking shelter from the flames. Throughout January 2020, Canberra, Australia’s capital city, was ranked as having the poorest air quality in the world, a consequence of dense bushfire smoke lingering across the region. As a result, Australia has become centre stage for the international climate change discussion.

Could these fires be viewed as a ‘Green Swan’ event – an extreme occurrence with catalytic outcomes, galvanizing governments and businesses into action to limit climate change and its global impacts?

As we embark on a new decade, it’s now timely to reflect on the past 10 years and consider how current and future agribusiness opportunities are positioned in the face of a rapidly changing climate. This article examines:

~ The realities of Australia’s current situation in the context of a warming planet, and why Australia remains attractive to global agribusiness investors;

~ Why, although government policy is important, it is really the allocators of capital that are emerging as the driving force in climate change response; and

~ How a regenerative approach to agriculture can be a major contributor to the climate solution.

Whilst devastating on a number of levels, these fires weren’t completely unexpected. In August of 2019 Professor Mark Howden, vice-chair of the Intergovernmental Panel on Climate Change (IPCC), stated “Across the globe, we’re seeing both changes in the intensity and seasonality of fires … that’s happening in Australia as well”. The professor was speaking at the launch of a special report released by the IPCC on climate change, desertification, land degradation, sustainable land management, and food security in terrestrial ecosystems.

Largely these fires were a consequence of Australia’s warmest and driest year on record, combining with lightning storms and conditions of extreme heat to create exceptionally challenging circumstances for emergency services. Recent rainfall across the eastern seaboard states has significantly abated the situation and the focus is now upon recovery for those communities affected.

As bad as these fires have been, it’s important to keep things in perspective. Australia is more than 21 times larger than Germany. It is a land of enormous diversity in geography, climate, ecosystems, and agriculture. Whilst the bushfire events unfolded on an unprecedented scale, they directly affected an estimated 0.7 percent of the Australian land area, of which only 14 percent affected agricultural land. Importantly, the agricultural areas impacted were largely in dryland/rainfed regions adjacent to the state forests and national parks where the fires occurred.

As the smoke haze across Australia’s cities temporarily forced the closure of public recreation areas and hospital admissions spiked, the impacts of the fires became real for all Australians. The silver lining to these extreme bushfire events is the welcome scrutiny it has placed on Australia’s, and other nations’ governments, to improve their existing climate change policies. However, it is becoming increasingly clear that decisions made by the allocators of capital will become the driving force influencing the climate change response going forward.

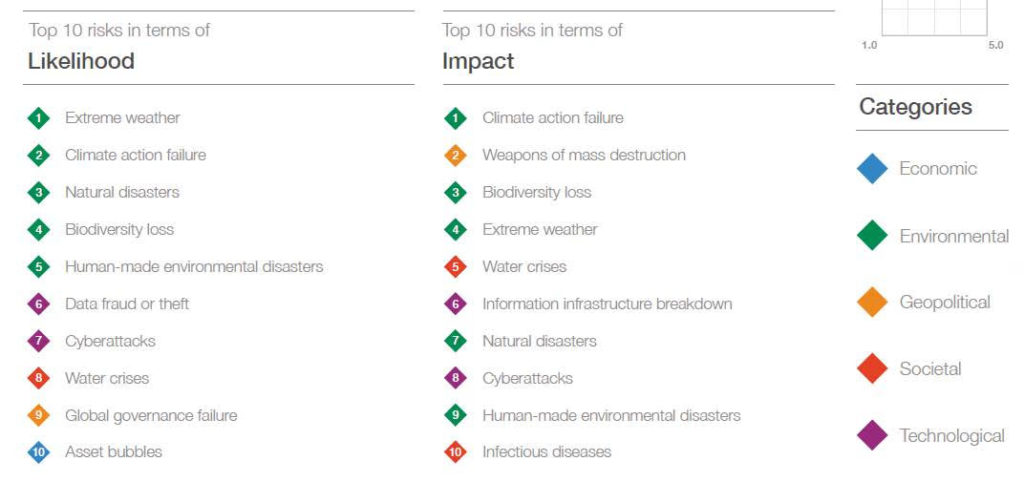

In the lead up to its 50th gathering in Davos, Switzerland, the World Economic Forum released its annual WEF Global Risks Report 2020. For the first time, the top five risks in terms of likelihood have been occupied by environmental risks (see Figure 1).

Figure 1: The most prominent global risks as per the WEF’s Global Risks Report 2020.

Source: The Global Risks Report 2020

Source: The Global Risks Report 2020

In Australia, the case of Mark McVeigh v. Retail Employees Superannuation Trust (REST), a AUD$57 billion pension fund, is receiving increasing media attention. In this potentially landmark case, McVeigh, a REST member, alleges the fund has failed in its fiduciary duty to protect his retirement savings from the financial losses that will flow from climate change. The case, which will be heard in the Federal Court in July 2020, could have a profound impact on the way the nation’s pension fund trustees invest Australians’ almost AUD$3 trillion in retirement savings.

At the same time, investors are clearly responding to these risks. In his annual January letter to global chief executives, Larry Fink, chairman and co-founder of Blackrock, a USD$7trillion and the world’s largest asset manager, announced that the firm would divest stocks in its actively managed portfolios of any company earning 25 percent or more of its revenue from thermal coal. Fink said “With the impact of sustainability on investment returns increasing, we believe that sustainable investing is the strongest foundation for client portfolios going forward.”

In a further statement Geraldine Buckingham, head of Blackrock Asia Pacific, was quoted as saying “This is really about us believing that these companies, given the carbon risk, represent poor sources of long term Alpha and we don’t believe it is in our clients’ best interest to be investing in them on their behalf.” Fink’s letter is indicative of a capital reallocation movement already underway and quickly building in momentum.

In August 2019 the Intergovernmental Panel on Climate Change (IPCC) released a special report on land use emissions. This report found that emissions from land use, largely agriculture, clearing, and forestry, make up 22 percent of the world’s greenhouse gas emissions. Including the entire food chain (fertiliser, transport, processing, and sale) raises this contribution up to 29 percent. Given the significance of this contribution the report found that it will be impossible to meet the goals of the Paris Climate Agreement without effectively managing emissions from land use.

The good news is that the adoption of regenerative agricultural practices provides a real opportunity for agriculture to play a significant role as a climate change solution. Regenerative agriculture is about producing more with less whilst delivering positive transformational change to the supporting environment. Its principles lie in a focus away from a traditional extractive, chemical intensive approach towards building soil and the terrestrial ecosystem health.

Soils alone have an enormous capacity to sequester a significant proportion of the atmosphere’s excess CO2, but they must be managed appropriately. Building soil organic matter contributes to improved moisture retention and resilience to wind and water erosion, whilst improving the microbial biodiversity that allows nutrients to be chemically available for plant uptake.

Almost always regenerative agricultural practices involve a number of elements undertaken simultaneously which are likely to include:

~ A focus on ground cover maintenance.

~ Adoption of cover cropping techniques to build soil organic matter;

~ Implementation of innovative compost application methods to rapidly build soil organic matter content; and

~ Adoption of new biotechnologies that assist plants in their CO2 sequestration capability and nutrient uptake efficiency.

These practices present their own challenges not only in their application, but importantly in their measurement. The old, but highly relevant adage ‘You cannot manage what you cannot measure’ still holds true. Progressive investors are now demanding (and rightly so) that managers demonstrate their ability to both implement these practices and measure and report on outcomes such as soil and ecosystem health. Ultimately, this global drive to pursue investments that can substantiate their environmental credentials is hugely encouraging.

Large-scale native vegetation clearing over 200 years has delivered legacy impacts that are still playing out across most continents. These include species decline and extinction, as well as significant soil and water degradation, which contributes to climate change by destroying large scale natural carbon sinks.

The UN’s Food and Agricultural Organisation (FAO) has stated that based on current systems, farmers will have to increase food production by 50 percent to meet the expected 2030 demand for food. Coupled with an actual decrease in available arable hectares per person due to land degradation and urbanisation, the outlook presents as one of increasing pressure on the world’s natural resource base.

If history is any guide, the response to increased food and fibre demand has often resulted in the development of the cheapest, easiest access to natural capital – replacement of natural ecosystems with agriculture. This approach overlooks the vast swathe of underutilised, already modified agricultural landscapes in preference for greenfield and newly ‘opened-up’ country.

Clearing of forest farming in Brazil, Africa, and even Northern Australia represents a view that the only form of valuable landscape production can be delivered by human intervention and transition from natural ecosystems to farming. Such a view neglects the underlying principle that life on earth is sustained by functioning and productive ecosystems, overlooking the fundamental value provided by natural ecosystems.

Photo: Almost one million hectares of Amazonian forest were lost to fires throughout 2019, reported as being a 77 percent year-on-year increase.

In the Australian states of Victoria and New South Wales, up to 70 percent of the primary terrestrial ecosystems that existed prior to European settlement have been cleared, replacing native ecosystems with intensive farming. In Australia’s irrigation areas specifically, most of this development occurred after the World Wars, and there remains significant underinvestment in farmland and water assets in Australia’s major irrigation food bowl, the Murray Darling Basin (MDB). The MDB represents only 14 percent of Australia’s land area yet generates 32 percent of Australia’s gross agricultural production, of which 37 percent is generated through irrigated agriculture. It is home to 40 Aboriginal nations and more than 90 species of waterbirds alone. It is therefore critically important that its natural resources and cultural heritage are managed sustainably.

The scale and extent of issues facing Australia’s (and the world’s) natural assets is a fundamental opportunity. The scope for new large-scale systems of capital allocation for landscape regeneration and ecosystem repair can deliver products and services that drive profitability and establish a long-term competitive position. Highly-modified agricultural regions with underutilised and undercapitalised land assets are key targets for intervention.

Already modified landscapes offer abundant opportunity, where the prudent application of new capital can transition obsolete irrigation systems into sustainable, high-value production systems. This approach delivers an outcome where ecosystem protection is reinstated, climate change resilience addressed, and production of food and fibre is increased through the highly-efficient use of land and water.

CASE STUDY EXAMPLE – Underutilised irrigation land

Photo A below displays an underutilised irrigation landscape. This site had not applied irrigation water for some years and was utilised for sporadic sheep grazing.

Photo B below shows the same farm in 12 months later, transformed and producing high-value field tomatoes, at an average yield of 125t/ha, generating gross margins of more than $3000/ha.

Increasingly, Australia has become an attractive destination for offshore institutions seeking uncorrelated, real asset backed returns from agriculture. Over the last five years the Australian Farmlands Index shows a total annualised return of more than 14 percent.

Factors supporting these levels of investment include:

~ A robust legal framework with strong protections for asset owners;

~ Availability of assets allowing for capital deployment at scale;

~ Globally competitive farm enterprises driven by a low subsidy environment;

~ Geographic proximity to large developing economies with market access underpinned by bilateral free trade agreements;

~ Strict biosecurity regulation;

~ A long track record of farmland value growth; and

~ Socio economic factors driving farm rationalisation and investment opportunity.

While the recent fires highlight the need to adopt a climate change lens over future Australian agricultural investments, all of these positive attributes remain in place.

The recent Global AgInvesting conference in London reflected the prevailing talking point of 2019: climate change and how the global community must respond. In an agricultural context, regenerative agriculture and measuring sustainability emerged as two broad subjects having now progressed to become either mainstream or highly sought-after manager competencies. The time of applying an ‘ESG lens’ as an investment screening mechanism has passed. It is now apparent that managers must demonstrate tangible capabilities in the deployment and ongoing management of investment capital that safeguard investors from climate change related risks.

Kilter Rural

Kilter Rural has been managing responsible investments in Australian irrigated rural land and water assets for institutional and wholesale investor clients since 2004. Its commitment to the protection and regeneration of Australia’s rural landscapes was recognised in 2019 via the Impact Asset Manager of the year award.

As a business founded on the principles of regenerating Australian agricultural landscapes, the loss of biodiversity and damage caused to sensitive ecosystems by the recent fires is devastating. The impact on native plant and animal species reinforces the case for the regeneration of biodiversity, and habitat protection, on farmlands.

For further information, please visit the Kilter Rural website.

DISCLAIMER

All views, data, opinions and declarations expressed are solely those of the author(s) and not of Global AgInvesting, GAI News, GAI Gazette, or parent company HighQuest Partners.

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.