November 30, 2017

![Insight Logo Col A4_CMYK[1]](https://www.globalaginvesting.com/wp-content/uploads/2016/06/Insight-Logo-Col-A4_CMYK1-300x229.png) |

UNDERSTANDING FARMLAND INVESTMENT |

INSIGHT FARMLAND PROFILE

Over many years Insight Farmland has built corporate farming expertise and strong institutional bridgeheads in key global agricultural geographies, with tried and tested people, processes and structures.

As part of Insight Investment, a leading global asset manager, Insight Farmland provides investors with access to the group’s robust infrastructure and systems.

A team of seasoned veterans offers long-term investment solutions to clients seeking inflation protection, diversification away from the mainstream, a broad mix of assets with adequate risk-adjusted return expectations, and the possibility of adding value through an appropriate

ESG framework.

FARMLAND – AT AN INFLECTION POINT?

Farmland is gradually becoming a mainstream allocation option for many institutional investors due to its potential for cash generation and real long-term growth, with low correlations to mainstream assets and exposure to attractive supply/demand dynamics. Farmland projects also lend themselves, by their very nature, to the pursuit of sustainable development goals.

There are two further arguments, less widely acknowledged, in favour of deploying private capital in global farming: farms’ potential for cash generation in light of inelastic demand for food, and the broad under-capitalisation of farming.

— Food production can be expected to consistently generate cash over the longer term because demand is largely inelastic. In other words, a fall in food prices below the cost of production is unlikely to be sustainable beyond a short period, as farmers need to earn enough money to feed a growing population. As a result, top-quartile producers who can produce food at the lowest cost can be expected to be profitable over the longer term.

— Secondly, farming is chronically and increasingly under-capitalised, with an equity gap in key supply geographies moving into the trillions of dollars. It is possible for investors to do simply what ‘needs doing’ – which farmers currently lack funds to do themselves – and to reap attractive returns, even without resorting to elaborate development programs.

However, market dynamics and the challenges presented by investing in a nascent asset class have affected how some investors perceive investments in farmland. This paper aims to explain the different ways in which investors typically access exposure to farmland, and ways to address the challenges of farmland investment, whether real or perceived.

ACCESSING FARMLAND INVESTMENT IN PRACTICE

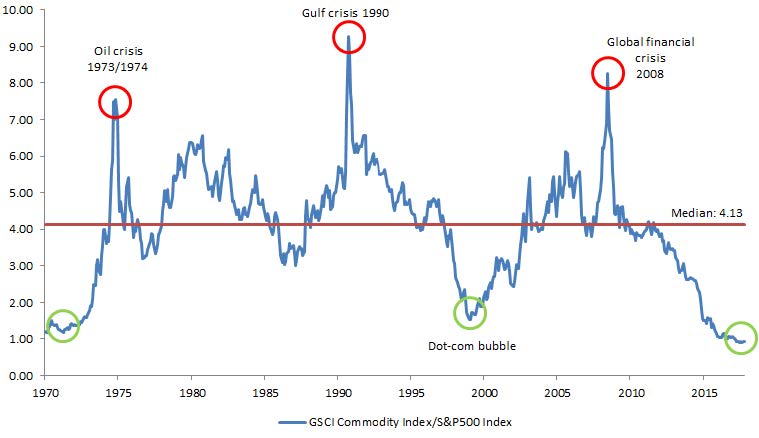

Today, farmland investments are potentially at a double inflection point in terms of both return potential and significance for investors: the asset class as such appears to be moving from a niche option into the mainstream, and commodity prices are near a historical low relative to equities (see graphic).

Equities expensive, commodities cheap?

Source: Dr Torsten Dennin, Incrementum AG.

An investor may therefore be convinced that, in theory, an investment in farmland is attractive. But unlike investments in equities or bonds, the options for investment in farmland are less familiar. Building a portfolio requires specialist analysis and expertise that very few asset managers are able to offer.

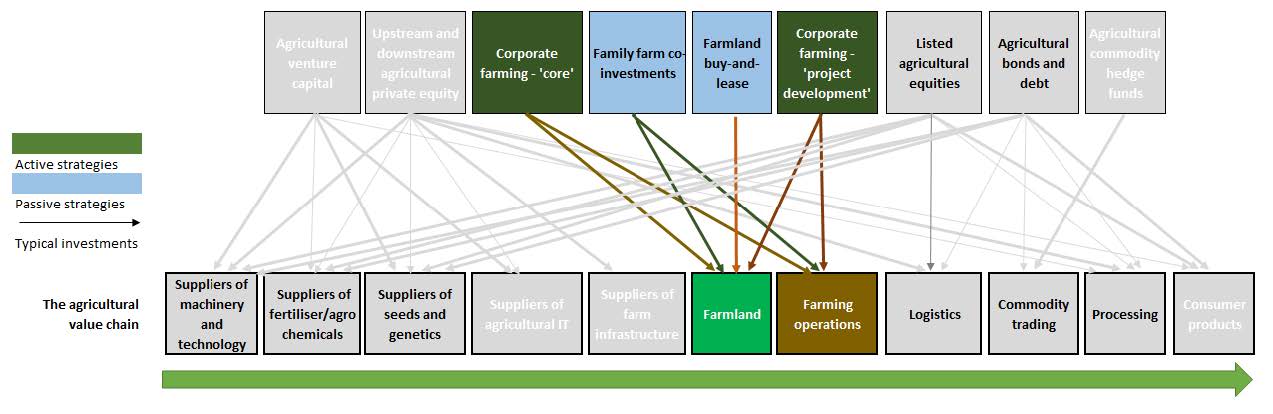

At first glance, an investor may be overwhelmed by the options available. He can gain exposure to agriculture via a range of investment vehicles and types, which in turn aim to generate profits from different points in the value chain. Investment vehicles range from venture capital and private equity funds, through to funding for holding companies for farms or family farms, to investments directly in agricultural projects. Investors may also seek exposure through mainstream financial markets – in other words, via listed companies, or debt issued by companies involved in agriculture. Exposure may be to businesses involved in supplying or supporting farms, through to farms themselves, or even to companies that make use of agricultural products.

Agricultural investment: a complex, multi-faceted universe

Source: Insight Investment. For illustrative purposes only.

As a starting point we propose to focus on farmland itself. The most common business models for doing so are corporate farming, focused either on a ‘core’ investment strategy or agricultural ’project development’; buy and lease; or a co-investment with a family farm.

Corporate farming – ‘core’

— Summary: “Owner-operator” model typically focused on mature assets with regular cash flows, but limited development potential.

— Benefits: This approach can offer a one-stop shop for exposure diversified across geographies and farm types, and the potential for economies of scale to boost returns and compensate for the costs introduced by a corporate overlay.

— Issues: The shortage of investment managers with the relevant experience, and the need to balance scale and diversity within the overall portfolio.

Corporate farming – ‘project development’

— Summary: “Owner-operator” model typically focused on ‘undiscovered’ assets with significant development potential.

— Benefits: This approach can offer the potential for material ‘private-equity-like’ returns.

— Issues: Execution risk is high – and again, there is a shortage of investment managers who have successfully executed such an approach.

Farmland buy and lease:

— Summary: “Passive owner” model – an investment vehicle owns farm assets and leases them to tenant farmer operators – typically focused on mature assets with regular cash flows, but limited development potential.

— Benefits: Buy-and-lease investments offer the potential for cost efficiency and scalability.

— Issues: They are typically limited to more mature regions with stable climates (such as the U.S. and Canada). Recently, driven among others by significant technological advances, food supply has swung back in line with demand, which is why the gap between income from farmland and the cost of leasing land has reverted back to long-term metrics. This means that buy-and-lease strategies will typically leave the investor landlord with relatively low risk-adjusted returns.

Family farm co-investments:

— Summary: “Passive owner” model – an investment vehicle owns shares in family farms but does not take an active role in their management or operations.

— Benefits: Possibility to combine family farm values with institutional governance – and a clear alignment of interest between farmers and investors.

— Issues: A successful investment will typically depend on selecting best-in-class farmers who need private capital – meaning deal flow is limited and investors may need to lock in capital for a long time. An element of project development may be necessary to compensate for the locking in capital, potentially increasing the complexity and risks inherent within the investment.

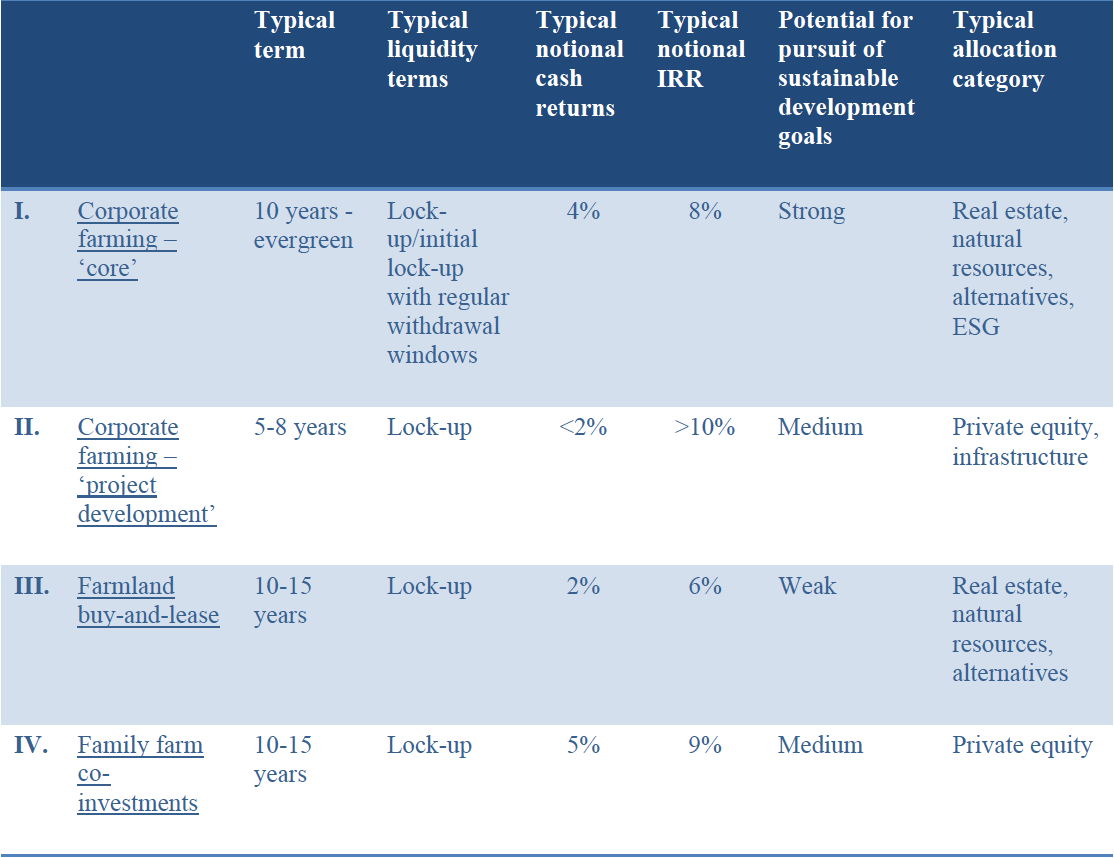

Selecting the most appropriate vehicle and approach for a farmland investment is crucial to ensure they are aligned to an investor’s specific objectives and requirements (see table).

The characteristics of the different models for farmland investment

Source: Insight Investment. For illustrative purposes only.

FARMLAND: ADDRESSING THE CHALLENGES

Some investors have misgivings about an asset class that is viewed as complex, illiquid, and at the mercy of unpredictable short-term disruptions such as weather events. These issues can be material, but it is possible to address them by identifying opportunities that:

— offer the potential for development;

— benefit from sustainably low production costs; and

— are based in a region that is politically stable and where foreign investors are welcome and able to hold assets without impediment.

In our experience, through the combination of detailed top-down analysis and the involvement of an extensive network of local practitioners, it is possible to identify potential investments that exhibit all these characteristics – and above all, capable farmers.

Farmland investments are local – and exhibit characteristics unique to their specific circumstances. A specific investment will probably be limited to a certain sector or region, reflecting an idiosyncratic risk/return profile that may not be in line with investors’ specific requirements. Local investment managers tend to focus on the benefits of their local operation, rather than on what makes sense for the investor. More broadly, the attractiveness of sectors, regions and strategies will change over time. We therefore favour a strategy that aims to diversify across different regions and types of farmland investment; that re-calibrates holdings counter-cyclically and balances return profiles; and that applies top-down analysis and expertise of a wide range of operations. We believe a balanced and geographically diversified portfolio established following a clear systematic discipline has a better chance of meeting investors’ return expectations, in terms of volatility and actual returns, than a direct investment in a specific asset.

Farmland investments require a long time horizon. There is a reason for the old adage that “farmers think in generations”: biological processes initiated to improve resilience and return potential of specific farming assets, and projects focused on safeguarding and improving sustainability, can take a long time to bear fruit. From a risk management perspective, in a diversified portfolio, fluctuations of both currencies and commodities can temporarily distort the performance of underlying assets, requiring patience on the part of the investor to allow time for such distortions to wash out (for example, for periods of low currency valuations to translate into high prices, or for low commodity prices to spark a supply response that ultimately leads to higher prices). These factors, from both agronomic and risk management standpoints, support arguments in favour of ‘evergreen’ investment structures without specified maturity dates but with regular liquidity windows.

Farmland investments do not always offer an illiquidity premium. It is necessary to distinguish between the liquidity of farmland investment vehicles – which typically commit investor capital for some years – and the liquidity of underlying farms. It is possible to sell individual farms if necessary or desirable; which means that it is possible to structure an evergreen farmland investment, with regular withdrawal periods, after an initial commitment period.

Farmland investments are costly to oversee. Compared to the family farm as the dominant structure and role model for global farmland investment, applying the governance and compliance structures required in an institutional investment management context can increase costs. This is why it is important to focus on farming systems that exhibit sufficient economies of scale to offset or even overcompensate such corporate overlay.

SUCCESSFULLY CAPTURING FARMLAND RETURN OPPORTUNITIES

We believe the most effective approach to investing in farmland is to aim for a portfolio diversified by geographies and products, focusing on identifying opportunities that capture the benefits of scale and exhibit demonstrable competitive advantages.

We also believe that a focus on alignment with the United Nations (UN) Sustainable Development Goals can ensure that assets are managed in a way that adds value both to the portfolio and wider society. Detailed reports and metrics demonstrating progress over time will give investors confidence that their investment is fulfilling their environmental, social, and governance (ESG) objectives.

To make the most of an allocation to farmland and facilitate the pursuit of sustainability targets, we clearly favour an evergreen structure, without a specified maturity date but with the potential for withdrawals after an initial commitment period. We consider this to be the effective approach for maintaining the potential for attractive returns, while also giving a portfolio the ability to develop and perform over the longer term.

***

|

Detlef Schoen joined Insight in August 2017 as Head of Real Assets and is responsible for all aspects of Insight’s farmland capability. Detlef has more than four decades of experience in global farming and a multi-billion dollar track record as a senior agribusiness executive. |

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.