August 19, 2021

By Stephen Johnston, Director, Veripath Partners

Sharpe ratio analysis is a well recognised tool in portfolio construction – the high-level concept being to maximise the expected return a portfolio will generate per expected unit of risk. More specifically:

“The Sharpe ratio was developed by Nobel laureate William F. Sharpe and is used to help investors understand the return of an investment compared to its risk. The ratio is the average return earned in excess of the risk-free rate per unit of volatility or total risk. Volatility is a measure of the price fluctuations of an asset or portfolio. Subtracting the risk-free rate from the mean return allows an investor to better isolate the profits associated with risk-taking activities. The risk-free rate of return is the return on an investment with zero risk, meaning it’s the return investors could expect for taking no risk (generally government bonds). Generally, the greater the value of the Sharpe ratio, the more attractive the risk-adjusted return.” Source: Investopedia

Canadian row-crop farmland investments have had Sharpe ratios materially higher than publicly traded equities and bonds over the last 30 years – meaning they produced much higher average returns over the risk-free rate per unit of total risk. For example, Canadian farmland Sharpe ratios over the last:

![]() 30 years – Canadian farmland – 0.6 or ~two times higher than the S&P 500

30 years – Canadian farmland – 0.6 or ~two times higher than the S&P 500

![]() 10 years – SK, AB, and MB farmland (~80 percent of Canada’s farmland) – 1.1 to 1.9 or ~five times higher than the S&P 500 for the equivalent period.

10 years – SK, AB, and MB farmland (~80 percent of Canada’s farmland) – 1.1 to 1.9 or ~five times higher than the S&P 500 for the equivalent period.

To put the Canadian farmland volatility/risk results into less abstract terms, over the last 30 years it witnessed only three down years (of modest magnitude), whereas over the same period S&P 500 had nine down years (of much larger magnitude). This is obviously a desirable behaviour for investors, and farmland is a valuable return enhancer in most traditional portfolios.

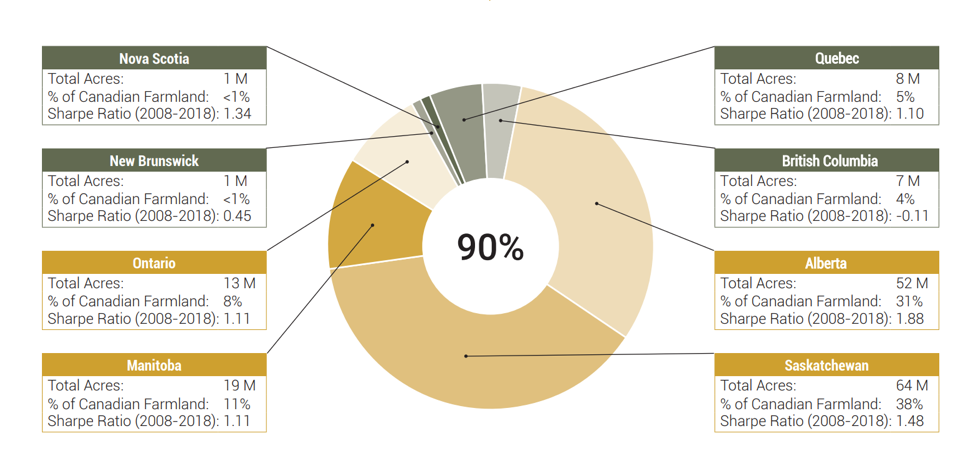

In general, our analysis gives us confidence in the overall superior nature of Canadian farmland Sharpe ratios. This analysis also assists to refine portfolio construction so that it moves beyond raw provincial acre weightings to further optimise returns by navigating the potential for material Sharpe ratio skew between the various provincial jurisdictions:

From the table above, it is clear that the biggest Canadian row-crop farmland market (Alberta, Saskatchewan, and Manitoba, representing 80 percent of total farmland) also has had the highest Sharpe ratios over the last decade.

From the table above, it is clear that the biggest Canadian row-crop farmland market (Alberta, Saskatchewan, and Manitoba, representing 80 percent of total farmland) also has had the highest Sharpe ratios over the last decade.

Given the diversifying (low correlation) features of Canadian row crop farmland investments, advisors tasked with portfolio construction for clients may want to consider the Canadian farmland asset class simply based on its ability to increase aggregate (countrywide) Sharpe ratio numbers – even without considering the other potential real return in the form of the productivity pricing discounts present in the prairies. We believe that such discounts are mean reverting and can be the source of incremental returns over and above how farmland has been performing generally in the Canadian market, and in other developed markets.

Our belief is that the analysis above drives a portfolio construction model, which generates extra weightings to Alberta, Saskatchewan, and Manitoba and that such a portfolio should outperform Canadian farmland benchmark returns for the foreseeable future – through improved capture of higher Sharpe ratios and productivity pricing mean reversion.

About the Author

Stephen Johnston has over 25 years experience as a fund manager from the debt and private equity perspectives. As a senior fund manager at Société Générale Asset Management UK, Johnston oversaw the private equity portion of a series of closed-end funds investing across all sectors in the emerging markets of the former Soviet Union, Eastern Europe, the Baltics, and the Middle East. He has been involved in multiple funds investing into the Canadian alternative space with AUM approaching $1 billion in aggregate – including strategies deploying capital into farmland, private credit, energy, and private equity. Johnston launched Canada’s first RRSP/TFSA eligible farmland investment vehicle and Veripath, one of Canada’s first open-ended farmland investment funds. He has a BSc. (1987) and a LLB from the University of Alberta (1990) and an MBA (1994) from the London Business School.

About Veripath

Veripath is a Canadian alternative investment firm. Members of Veripath’s management team have decades of farmland, private equity, and private credit investment experience. Veripath implements its farmland strategy in a way that seeks to preserve, as far as possible, farmland’s low-volatility return profile – the attribute that generates a material portion of Canadian farmland’s superior risk adjusted returns. Veripath does this by seeking to minimize operational, weather, geographic, and business-related risks – and capture the pure return from land appreciation. Veripath uses a unique split fund, evergreen structure which opens the Canadian farmland thesis to the largest possible universe of investors, and for the first time makes compliance with the various provincial farmland ownership regulations simple and straightforward. Canadian farmland allocations have several compelling characteristics that make them a worthwhile portfolio allocation for both institutional and retail investors, and Veripath’s structures are available to both. For more information on Veripath, visit veripathfarmland.com.

* All views, data, opinions and declarations expressed are solely those of the author(s) and not of Global AgInvesting, GAI News, or parent company HighQuest Group.

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.