March 25, 2019

by Lynda Kiernan, editor, GAI Media

GAI News has been running a new feature called “Question of the Month”. Below are the expanded results of the first month’s responses, along with commentary from GAI News Editor Lynda Kiernan.

Question:

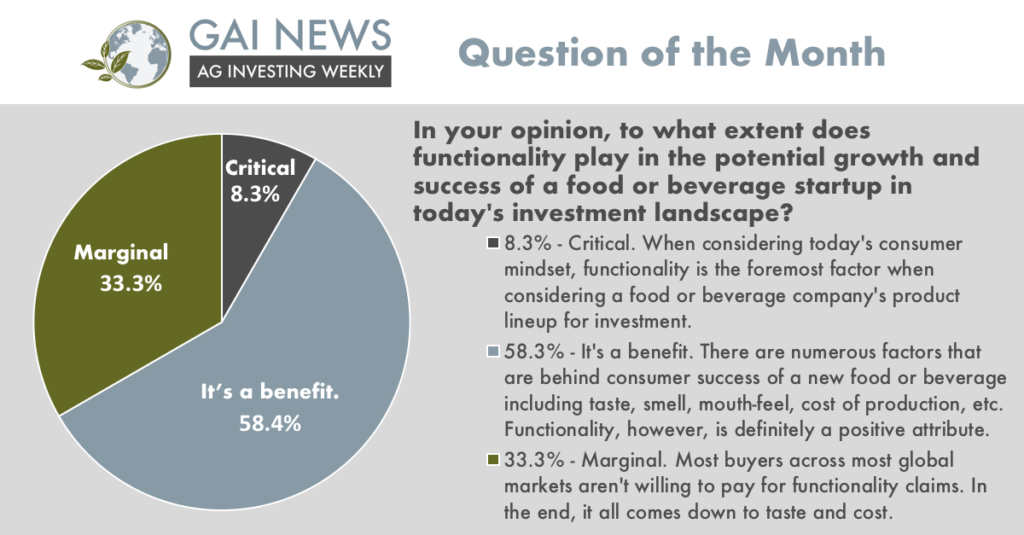

BFG’s initial target is functional beverages after closing BFG II oversubscribed at more than $100 million. In your opinion, to what extent does functionality play in the potential growth and success of a food or beverage startup in today’s investment landscape?

Wrap Up:

In recent years, product development in the food and beverage industries has seen rapid change, causing investors to have to be ahead of the consumer curve. One factor that has risen to be a leading consideration is functionality.

When asked to what extent functionality plays in the potential growth of a food or beverage startup, the majority of our respondents had a measured approach, with 54.5 percent stating that functionality is definitely a positive attribute, however, it is one among many factors behind the success of a new product, such as taste, smell, mouth-feel, and cost of production, among others.

Meanwhile, 36.4 percent of respondents, or little more than one third, state that food and beverage functionality is a marginal concern, noting that across most global markets, consumers aren’t willing to pay for functionality claims; that in the end it all comes down to taste and cost.

In the opposite direction, 9.1 percent of respondents state that functionality in a new food or beverage is critical given today’s consumer mindset.

BFG is one of the latest investors to set its sights and its capital on an investment with a nod to functionality. When Kellogg’s launched its venture capital arm, eighteen94, its first investment was in Kuli Kuli, a functional foods startup and manufacturer of moringa-based bars, powders, and energy shots.

That same year, Campbell Soup made a bold move, expanding into organic and functional foods with a $700 million deal to acquire Pacific Foods, a leading producer of organic soups and broths, as well as shelf-stable, plant-based meals, beverages and side dishes.

Meanwhile, CAVU Venture Partners has made more than one investment in the functional food arena, leading a $20 million round in May of last year for REBBL, a maker of organic and functional coconut milk-based, super-herb beverages, and an $8 million investment in Kettle and Fire, a maker of grass-fed bone broths, soups, and chili, only months later.

These are but a few recent investments that have touched upon functionality, but as our population ages, and health and wellness play ever greater roles in consumers’ everyday decisions, we may see the number of such investments climb.

Indeed, the global functional food and beverage market is expected to see growth of approximately 8 percent annually through 2021, according to a report issued by Technavio. And by 2025, Zion Market Research forecasts that the market will have climbed to a value of just under $10 billion, with a sustained CAGR of 6.74 percent between 2019 and 2025.

-Lynda Kiernan

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.