April 12, 2024

Brent McGowan

Managing Director, Global Head of Agricultural Operations

Weiyi Zhang, Ph.D.,

Associate Director, Agricultural Economics

Hannah Barkan

Manager, Impact Investing & Natural Climate Solutions

Feeding a growing population in a world of increasingly scarce natural resources will require sustainable solutions, which is where regenerative agriculture could play a critical role. For investors, building and sustainably managing a globally diversified portfolio of agricultural assets can generate competitive risk-adjusted returns while providing socioeconomic and environmental benefits to the rural communities in which the properties are located and the wider global markets the farmlands serve.

What is regenerative agriculture?

Our definition of regenerative agriculture centers on soil health, defined as a farmland management framework by which the goals of soil health and productivity guide management decisions and in turn lead to optimized farm production, biodiversity, and sequestering atmospheric carbon into soil. This holistic approach to agriculture aims to optimize financial returns, foster continuous improvement in land management, and preserve natural resources.

Regenerative agriculture isn’t new to us

Long before the term regenerative agriculture became a popular investment theme, we at Manulife Investment Management, with three-plus decades of experience investing in natural capital, have incorporated regenerative practices in the management of agricultural assets.

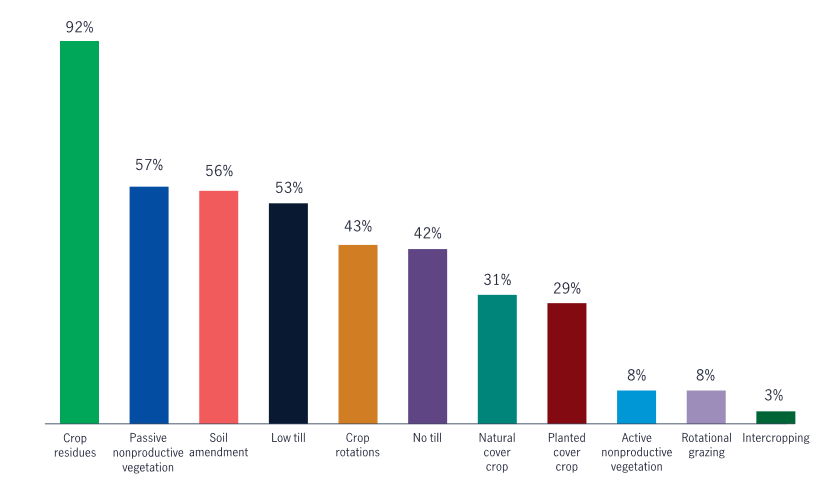

Today, we employ regenerative practices on 100 percent of the properties we manage. Furthermore, three-quarters of these properties employ four or more distinct regenerative practices. Examples of regenerative practices that are currently in use across managed properties include low-till and no-till practices, which focus on reduced soil disturbance; diverse planted cover crops that help reduce soil erosion and prevent runoff; and using multiple crops in rotation that encourage soil ecosystem restoration, among many others.

Regenerative practices have long been core to farmland management at Manulife Investment Management

Share of our managed properties employing regenerative practices

Soil health is at the center of regenerative agriculture

While the positive effects of regenerative practices are manifold, the fundamental pillar of regenerative agriculture is the improvement of soil quality. By accumulating more soil organic matter and enhancing microbial activity, regenerative practices contribute to healthier soils, enhance water infiltration capacity and water retention in soils, and help mitigate the impacts of droughts and floods while promoting more resilient agricultural systems.

With the focus on soil health, regenerative agriculture offers significant potential for carbon sequestration. Practices such as cover cropping, no-till farming, and the use of biochar increase soil carbon storage capabilities, providing the potential to mitigate climate change by removing carbon dioxide from the atmosphere and storing it in the soil. Similarly, these practices also help to improve soil structure and expand ground cover, making regenerative farming practices effective in reducing soil erosion rates, preserving valuable topsoil, and preventing sediment runoff into waterways.

~ Case study: creating a 360° loop for reusing agricultural waste

Working with universities and agronomists, our agricultural asset management team in Grandview, Washington, is experimenting with reincorporating agricultural debris back into the soil ecosystem. On a 16-acre apple orchard, old apple trees were removed to prepare for new development, leaving behind large amounts of wood debris. The crew divided the parcel into six different trial plots to assess the effectiveness of different approaches used to treat the wood debris. This included the use of biochar—a porous carbon substance made from burning wood in the absence of oxygen and which acts as a soil nutrient stabilizer—and treating the chipped wood with manure from a nearby dairy farm.

Where possible, we’re working to use feedstocks from our own orchards, and nearby forest properties were used to generate biochar, creating a 360° loop in the use of materials and reducing the cost of transporting biochar. We believe that these trials will demonstrate the additional carbon benefits of leaving most of the removed biomass in the orchard instead of burning the removed debris, which would release carbon into the atmosphere. This adds organic matter to the soil while helping neighboring farmers dispose of agricultural waste.

Regenerative practices enhance biodiversity

Regenerative agriculture also supports biodiversity by creating habitat diversity and promoting ecological balance. Common practices such as growing native and diverse plants provide essential habitats for a wide range of plant and wildlife species. These practices create diverse land covers that not only improve soil resilience, but also provide varied habitats for wildlife.

Many regenerative practices incorporate natural areas such as riparian zones and native grasslands into their landscapes, provide wildlife corridors that allow species to move freely, and maintain diversity within wildlife populations. These habitats provide food, shelter, and breeding sites for beneficial organisms such as pollinators, natural predators, and soil microbes, contributing to overall biodiversity on the farm.

Furthermore, regenerative practices focusing on pest management prioritize natural pest control mechanisms and use a combination of cultural, biological, and mechanical control methods. This can help reduce reliance on chemical pesticides while promoting the growth of beneficial organisms that help manage pest populations naturally.

~ Case study: building a system of regenerative practices on row crop properties

On an irrigated corn/soybean farm in north central Nebraska, one of our tenants is taking a regenerative approach to managing his farm and reducing the reliance on purchased fertilizers. This tenant uses hog manure from a neighboring farm and applies the animal waste to supplement the nutrient needs of soil. Through the use of both soil and aqueous wastes to supplement the soil with nitrogen, phosphorous, and potassium, this tenant has created a symbiotic system in which crop production and animal protein production benefit each other, lowering the usage of synthetic fertilizers while mitigating carbon emissions at the same time.

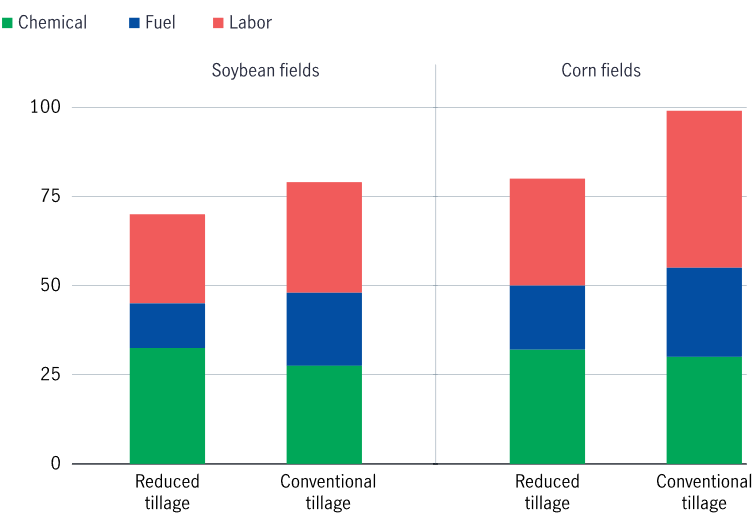

Lower growing costs are a result of regenerative practices

While the practices mentioned above focus on biodiversity and soil health, they also translate into reducing the use of inputs and growing costs for farmers. Healthy soils are naturally fertile and contain high levels of organic matter. By enhancing soil structure, nutrient cycling, and microbial activity, regenerative agriculture optimizes nutrient availability to plants, reducing the need for external inputs, which naturally reduces the amount spent on synthetic fertilizers.

With the goal of improving soil health, regenerative practices such as cover cropping and mulching help to suppress weed growth and enhance soil moisture, reducing the need for irrigation and synthetic herbicides. Regenerative pest management practices through pest population monitoring, enhancing habitat diversity for natural enemies, and implementing preventive measures can help to minimize the need for chemical pesticides and reduce input costs while maintaining effective pest control. Additionally, some practices, such as low-till and no-till farming, can help reduce the reliance on machinery, not only saving on rising costs such as fuel and energy, but also lowering the financial burden of maintenance and machine operating costs.

~ Case study: pilot soil carbon projects across regions

Working with various partners, we’ve enrolled several properties under management in a pilot soil carbon project in Alabama, Arkansas, Texas, and Tennessee. This pilot program can help support farmers generate high-quality soil carbon and greenhouse gas credits on over 2,300 acres of farmland by incorporating regenerative practices such as nutrient management, reduced tillage, and cover crops, and help to offset up-front costs associated with sustainable farming practice implementation. Through participating in the project, farmers who are new to carbon markets also receive the additional benefits of the knowledge and experience of working with private voluntary ecosystem marketplace.

Good stewardship is good business

Positive ecological and environmental impacts, together with limiting input use and lowering costs, enhance returns for farmers and investors, demonstrating that good stewardship is good business. Regenerative practices offer opportunities for farmers to enhance their financial returns over the long term. By improving soil health and fertility, regenerative agricultural practices can lead to increased crop yields and reduced dependency on costly inputs such as synthetic fertilizers and pesticides with potential additional income streams, including additional carbon credit payments. Additionally, regenerative approaches encourage farmers to adopt adaptive management strategies, continuously improving their land management practices based on ecological feedback. This adaptive approach enables farmers to optimize resource utilization and maximize productivity sustainably, enhancing the potential for positive financial returns.

Reduced input and growing costs associated with select regenerative agricultural practices

Average costs on select production cost categories based on sampled soybean and corn fields ($/acre)

Certification: a proactive step to address challenges

Despite the numerous promises of regenerative agriculture, there exist challenges that may hinder its widespread adoption. A key barrier is the current market incentives that may still favor conventional practices. The agricultural community at large can be risk averse in the context of wide adoption of regenerative agriculture, especially when faced with the uncertainties surrounding yield variability, pest management effectiveness, and the lack of proven financial success. While it takes a concerted effort to increase awareness among farm operators about the benefits of regenerative agriculture and broadcast the success stories to highlight its benefits, a key step that an institutional investment manager can proactively take is participating in certification programs that recognize and reward farmers for adopting regenerative practices. Manulife Investment Management, with a few of our peers, helped to found Leading Harvest, a nonprofit organization that mobilizes the entire value chain through third-party audited standards, outcome-driven collaborations, and a learning network to accelerate the transition to a more sustainable and resilient global agricultural system. Leading Harvest, through its 13 principles guiding the standard of agricultural practices, provides trusted validation of sustainable practices, especially those that enhance soil health. By collaborating with industry partners and third-party certification bodies, the industry can establish credible standards and certification criteria for sustainable agriculture.

Our commitment to continued progress

Manulife Investment Management holds a strong belief and firm conviction in investing in regenerative agriculture, recognizing regenerative agriculture’s pivotal role in bolstering the sustainability and resilience of our agricultural systems while providing investors with positive financial returns. By dedicating ourselves to progressing toward a regenerative system of sustainable management, we aim to not only maximize financial returns but also to quantify the substantial ecological impact of regenerative agriculture at scale. By supporting our farm management teams and our tenants to scale up regenerative practices, we’re not just growing crops, we see ourselves nurturing long-term, resilient assets that can sustainably nourish both our communities and our planet for generations to come. Together, we can forge ahead in our journey toward a regenerative future, where thriving ecosystems and thriving economies go hand in hand.

*For Institutional/Investment Professional Use Only. Not for distribution to the public.

Important disclosures

Investing involves risks, including the potential loss of principal. Financial markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. These risks are magnified for investments made in emerging markets. Currency risk is the risk that fluctuations in exchange rates may adversely affect the value of a portfolio’s investments.

The information provided does not take into account the suitability, investment objectives, financial situation, or particular needs of any specific person. You should consider the suitability of any type of investment for your circumstances and, if necessary, seek professional advice.

This material is intended for the exclusive use of recipients in jurisdictions who are allowed to receive the material under their applicable law. The opinions expressed are those of the author(s) and are subject to change without notice. Our investment teams may hold different views and make different investment decisions. These opinions may not necessarily reflect the views of Manulife Investment Management or its affiliates. The information and/or analysis contained in this material has been compiled or arrived at from sources believed to be reliable, but Manulife Investment Management does not make any representation as to their accuracy, correctness, usefulness, or completeness and does not accept liability for any loss arising from the use of the information and/or analysis contained. The information in this material may contain projections or other forward-looking statements regarding future events, targets, management discipline, or other expectations, and is only current as of the date indicated. The information in this document, including statements concerning financial market trends, are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Manulife Investment Management disclaims any responsibility to update such information.

Neither Manulife Investment Management or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained here. All overviews and commentary are intended to be general in nature and for current interest. While helpful, these overviews are no substitute for professional tax, investment or legal advice. Clients should seek professional advice for their particular situation. Neither Manulife, Manulife Investment Management, nor any of their affiliates or representatives is providing tax, investment or legal advice. This material was prepared solely for informational purposes, does not constitute a recommendation, professional advice, an offer or an invitation by or on behalf of Manulife Investment Management to any person to buy or sell any security or adopt any investment strategy, and is no indication of trading intent in any fund or account managed by Manulife Investment Management. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification or asset allocation does not guarantee a profit or protect against the risk of loss in any market. Unless otherwise specified, all data is sourced from Manulife Investment Management. Past performance does not guarantee future results.

Manulife Investment Management

Manulife Investment Management is the global wealth and asset management segment of Manulife Financial Corporation. We draw on more than a century of financial stewardship to partner with clients across our institutional, retail, and retirement businesses globally. Our specialist approach to money management includes the highly differentiated strategies of our fixed-income, specialized equity, multi-asset solutions, and private markets teams—along with access to specialized, unaffiliated asset managers from around the world through our multimanager model.This material has not been reviewed by, is not registered with any securities or other regulatory authority, and may, where appropriate, be distributed by the following Manulife entities in their respective jurisdictions. Additional information about Manulife Investment Management may be found at manulifeim.com/institutional

Australia: Manulife Investment Management Timberland and Agriculture (Australasia) Pty Ltd, Manulife Investment Management (Hong Kong) Limited. Brazil: Hancock Asset Management Brasil Ltda. Canada: Manulife Investment Management Limited, Manulife Investment Management Distributors Inc., Manulife Investment Management (North America) Limited, Manulife Investment Management Private Markets (Canada) Corp. Mainland China: Manulife Overseas Investment Fund Management (Shanghai) Limited Company. European Economic Area Manulife Investment Management (Ireland) Ltd. which is authorised and regulated by the Central Bank of Ireland Hong Kong: Manulife Investment Management (Hong Kong) Limited. Indonesia: PT Manulife Aset Manajemen Indonesia. Japan: Manulife Investment Management (Japan) Limited. Malaysia: Manulife Investment Management (M) Berhad 200801033087 (834424-U) Philippines: Manulife Investment Management and Trust Corporation. Singapore: Manulife Investment Management (Singapore) Pte. Ltd. (Company Registration No. 200709952G) South Korea: Manulife Investment Management (Hong Kong) Limited. Switzerland: Manulife IM (Switzerland) LLC. Taiwan: Manulife Investment Management (Taiwan) Co. Ltd. United Kingdom: Manulife Investment Management (Europe) Ltd. which is authorised and regulated by the Financial Conduct Authority United States: John Hancock Investment Management LLC, Manulife Investment Management (US) LLC, Manulife Investment Management Private Markets (US) LLC and Manulife Investment Management Timberland and Agriculture Inc. Vietnam: Manulife Investment Fund Management (Vietnam) Company Limited.

Manulife, Manulife Investment Management, Stylized M Design, and Manulife Investment Management & Stylized M Design are trademarks of The Manufacturers Life Insurance Company and are used by it, and by its affiliates under license.

*The content put forth by Global AgInvesting News and its parent company HighQuest Partners is intended to be used and must be used for informational purposes only. All information or other material herein is not to be construed as legal, tax, investment, financial, or other advice. Global AgInvesting and HighQuest Partners are not a fiduciary in any manner, and the reader assumes the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on this site.

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.