March 28, 2023

By Ben Palen, Ag Management Partners

In the course of a four-decade career in agriculture, I have gleaned information from a number of sources. The insights of others, along with my own experiences, have shaped my thinking about the nature of this business and its potential trends.

There are a small number of articles that have stood out for their thoughtful observations, and in particular one has been thumbtacked to a wall in my office since it was written in March of 2019. The author was Jerry Gulke, who has provided his insights via a column in Farm Journal for a number of years. The title of the article was “Are We Witnessing a Resetting of Agriculture.” He correctly noted that the bull market in commodities that had begun in 2007 (with the ethanol mandates) had by then (early 2019) given back most if not all of its gains.

The context for his article was a pending trade deal between the U.S. and China. He mentioned that the “ag world changed in the past 10 months.” He was in-part referring to the imposition of billions of dollars of tariffs on certain Chinese imports, supposedly in the name of helping non-agricultural sectors of the U.S. economy. Further, he said that grain flows, and their “distorted logistics”, had led to material changes in patterns of trade. Finally, he noted that no textbooks had yet been written to deal with this “resetting of agriculture.”

He closed with the comment that the events of the past 10 months could not be underestimated or ignored, and he offered the advice gained from his parents, who were children during the Great Depression, to “expect the best, but prepare for the worst.”

In pondering the events of recent months, such as the Russian/Ukrainian war, the doubling of certain key interest rates, strained relations between the U.S. and China, double-digit increases year-over-year in land prices, a sharp decline in some commodity prices, the substantial increases in input costs, and the emerging crisis in parts of the banking sector, all against a backdrop of climate change, storm clouds looming over the ethanol industry (a key user of corn), and chatter about declining population growth trends in China, I have wondered whether another resetting is taking place, or is about to begin. Just the other day, a farm manager with clients in 20 states and Canada noted to me that, based on a survey of many of his farmer clients, a 70 cent per bushel decline in the price of corn or beans would put 80 percent of his clients in the red.

The word “sustainable” comes to mind when considering the trends in agriculture with respect to income levels and land price increases over the past few years vis-a-vis the above-noted items. While that word “sustainable” is perhaps overused in another context, arguably it is appropriate here. Have we reached a point where “unsustainable” enters into the conversation about the notion of a reset for agriculture? While the signs may not yet be blinking red, there are legitimate concerns. There are a multitude of reasons for that opinion.

First, it is undeniable that climate change is wreaking havoc in certain areas of the world, whether through a reduction in arable areas, a decline in overall crop production, or the combination of both. While there have been significant advances in crop genetics and overall farming methods to mitigate some of the impacts, no foreseeable changes in the two factors can, for instance, replace the sheer lack of water available in the Colorado River basin to continue the status quo of irrigated agriculture. In China, the extent of arable land has shrunk, and, again, there seems to be no magic bullet to change the effects of climate factors.

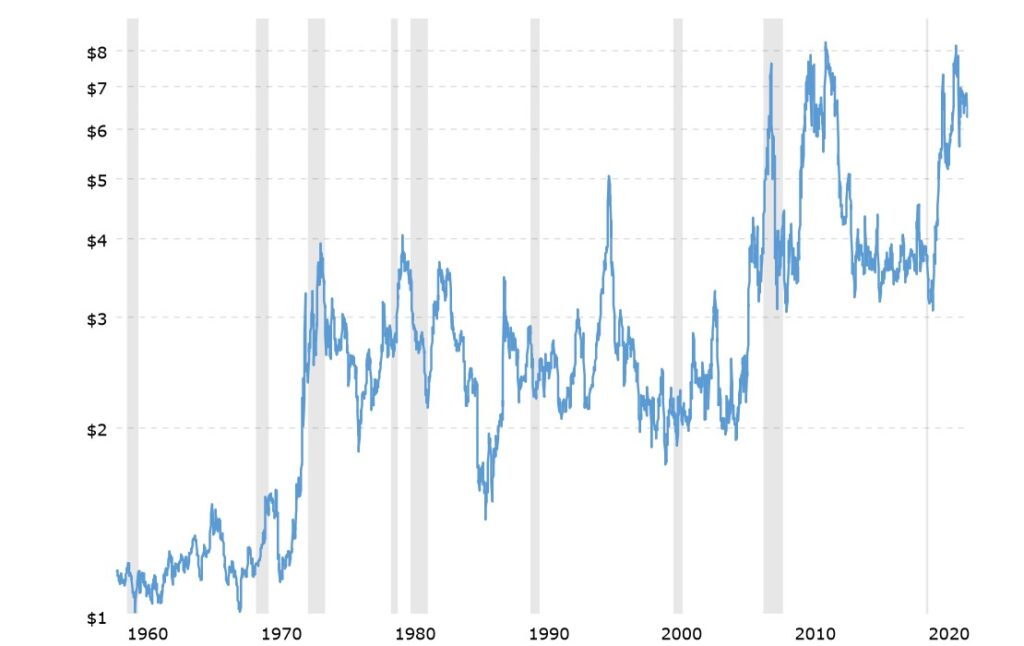

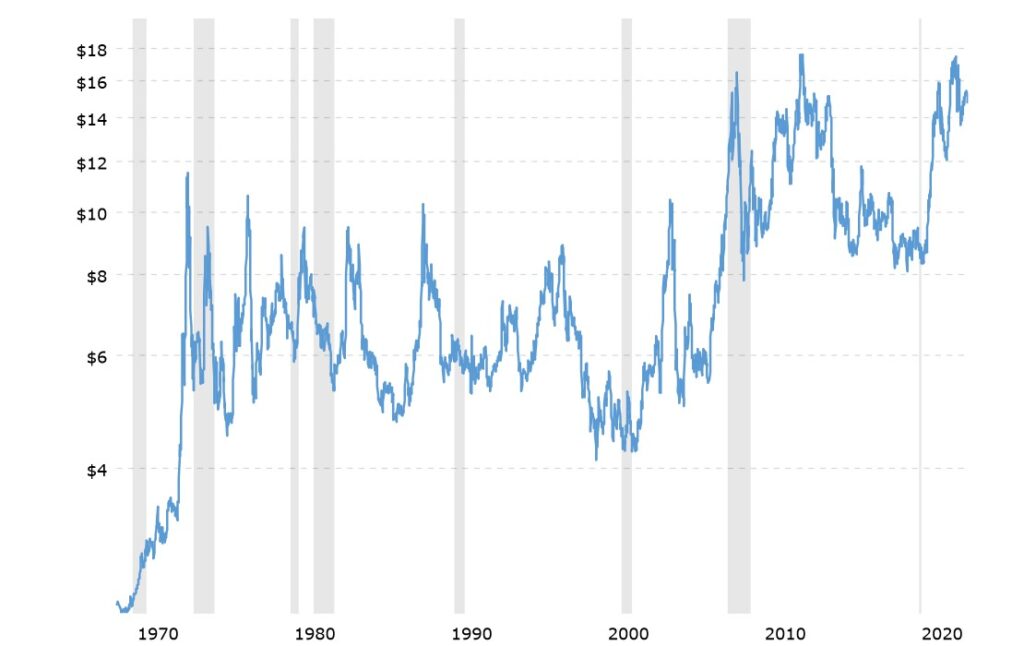

Second, there are lessons from history that must not be forgotten. Short-term thinking does not mesh well with long-term assets. A look at the following price charts for corn and soybeans tells us why.

We have been in a strong bull market for a few years, but now the world is different in so many ways. It could be said that the only certainty is uncertainty. Suppose China stops buying corn and beans from the U.S.? Is that unthinkable? Or suppose that key commodity prices fall by 25 percent? How is that $30,000 per-acre land purchase going to look at that point? How much land has been bought in the past couple of years based on the present, with insufficient attention paid to the past? Will other non-food uses for certain crops blunt the impact of these potential “gotchas”?

I do not claim to have the answers to the above questions, or to others like them. What my experiences tell me though, is that we are in for a reset. When a respected farm manager says that a 70 cent per bushel decline in the price of corn or beans would put 80 percent of his clients in the red, we are way beyond discussions of theory. Gravity seemingly has to come into play. A wise strategy for those of us involved in agriculture might be something along these lines:

~ Geographic and crop diversity (where practical).

~ Use of emerging risk mitigation tools, such as parametric revenue protection.

~ Identity-preserved crops that are demonstrably sustainable as measured by true metrics.

~ Use of bio products that reduce the carbon footprint of conventional fertilizer and other inputs.

~ Different risk sharing models with farm operators.

~ Thoughtful approaches to how ag can contribute to reduced carbon levels in the world.

Above all, there are two things to keep in mind that are not found in a textbook: perspective and patience. Both important guides for all of us in times of uncertainty. And I think that they are especially applicable in agriculture today.

ABOUT THE AUTHOR:

Ben Palen is a fifth generation farmer with experience in many aspects of agriculture, including projects in the United States, Africa, and the Middle East. The focus on all projects is sustainable practices based on a mix of boots-on-the-ground work and selected use of agtech tools.

*The content put forth by Global AgInvesting News and its parent company HighQuest Partners is intended to be used and must be used for informational purposes only. All information or other material herein is not to be construed as legal, tax, investment, financial, or other advice. Global AgInvesting and HighQuest Partners are not a fiduciary in any manner, and the reader assumes the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on this site.

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.