February 12, 2021

By Richard Lane, Executive Director, Birdwood Capital

“If you have not explored the institutional opportunity set in Paraguayan agriculture already, you should,” is no longer a bold statement.

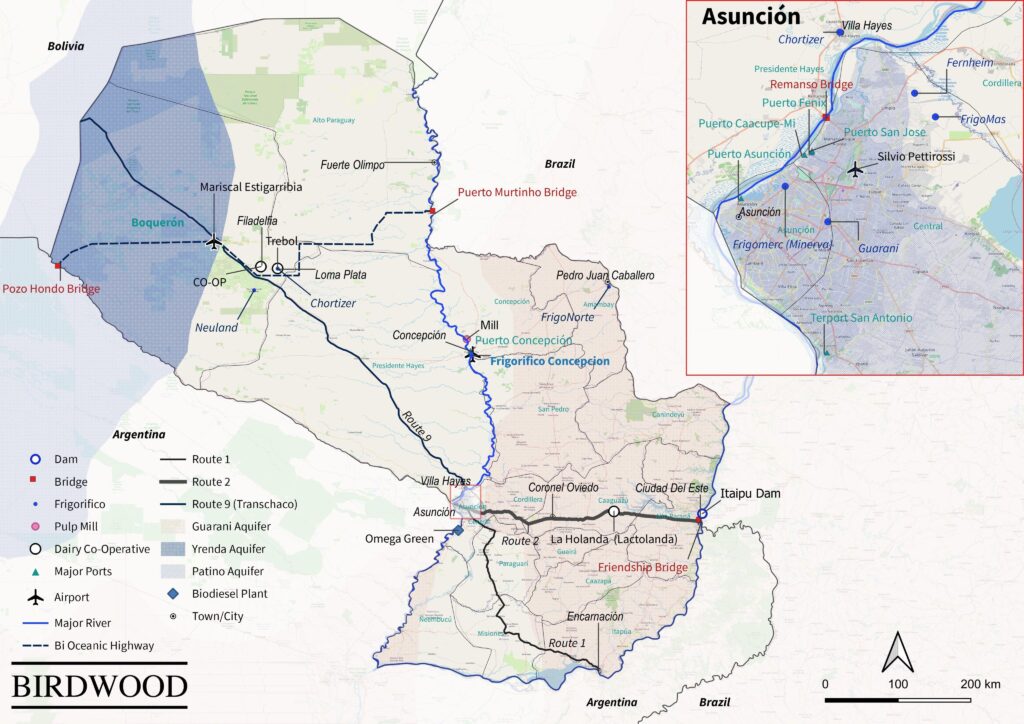

Paraguay, often mistaken as a province of much smaller Uruguay, is nestled, erstwhile swallowed, between the two agricultural giants Brazil and Argentina. It has been a consistent beacon of macro and regulatory stability in a broader region marked by political swings-and-roundabouts. Importantly, as further distinctions from its neighbors and most contemporary global jurisdictions, Paraguay boasts one of the most generous corporate tax systems in the world and permits foreigners to acquire productive agricultural lands at scale without restriction.

Agriculturally, Paraguay has propelled itself to become the world’s fourth largest soy/soy derivatives exporter, the eighth largest beef exporter, and fourth largest starch exporter – which, like the lack of restrictions on acquisition of rural lands, does surprise much of the northern hemisphere institutional agri investor community with whom we speak. Though capital markets have priced the Paraguay sovereign as investment grade for several years, Paraguay’s success in agri production has come despite foreign direct investment being just embryonic in the past. Whilst growing and punctuated by recent large ticket investments from mainstay institutions such as Goldman Sachs, Deutsche Investitions, and others, the Paraguayan market generally remains uncrowded with superior risk-adjusted investment returns available for real asset investors.

Agriculturally, Paraguay has propelled itself to become the world’s fourth largest soy/soy derivatives exporter, the eighth largest beef exporter, and fourth largest starch exporter – which, like the lack of restrictions on acquisition of rural lands, does surprise much of the northern hemisphere institutional agri investor community with whom we speak. Though capital markets have priced the Paraguay sovereign as investment grade for several years, Paraguay’s success in agri production has come despite foreign direct investment being just embryonic in the past. Whilst growing and punctuated by recent large ticket investments from mainstay institutions such as Goldman Sachs, Deutsche Investitions, and others, the Paraguayan market generally remains uncrowded with superior risk-adjusted investment returns available for real asset investors.

Birdwood, based in Asunción and managed by JP Morgan and Goldman Sachs alum, has hand-picked a 140,000-hectare, contiguous, world-class beef and grains aggregation in a zone of the Paraguayan Chaco, following an extensive in-house process of commercial, financial, operational, and physical/agri due diligence. Birdwood’s positive view is echoed by respected leaders in global agribusiness and agri capital markets with whom the firm works closely.

Against the backdrops of a growing, freshly dedicated ‘agriculture’ asset class, heightened food-security emphasis, increasingly scarce, scalable opportunity sets, zealous, resource-nationalist politicians, and increasingly muted operating returns and capital growth in the developed agri world – Paraguay is open for business.

ABOUT THE AUTHOR:

Richard Lane is a former Investment Banker at JP Morgan in London. Since moving to South America in 2014 he has been involved in a number of start-up and corporate finance projects. In 2020 he joined Birdwood, a corporate finance boutique principally focused on Paraguay and agri deals.

Richard Lane is a former Investment Banker at JP Morgan in London. Since moving to South America in 2014 he has been involved in a number of start-up and corporate finance projects. In 2020 he joined Birdwood, a corporate finance boutique principally focused on Paraguay and agri deals.

For more information, please contact:

Richard Lane

rich@birdwoodcap.com

www.birdwood.com.py

*All views, data, opinions and declarations expressed are solely those of the author(s) and not of Global AgInvesting, GAI News, GAI Gazette, or parent company HighQuest Group.

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.