November 15, 2021

By Himanshu Gupta, CEO of ClimateAi

Climate change is what we call the new “über-variable” that will shape investors’ risks and returns more than any other variable over the coming years and decades.

Currently, traditional portfolio investing relies on making decisions that balance risk and reliability — at the right time. However, climate change urgently threatens to upend this balance by accelerating shifts in nearly every decision-critical factor, from weather disruptions to yields to input prices to labor to interest rates. It’s likely that at least some part of every investor’s portfolio has experienced a climate change-related event, leading to undesirable volatility.

Forward-thinking investors need to anticipate these unprecedented changes and can find tremendous value in preparing for climate risk with strategies that uncover and avoid unforeseen risks. These are all the pieces of conventional wisdom about the investment risk landscape that climate change is proving wrong, and how investors can prepare or avoid these traps.

Myth #1: Past performance of investments is a predictor of future performance.

Historical numbers and metrics have long helped guide investment decisions. But in a warming world, historical averages can’t offer much insight.

For example, imagine you have a portfolio of almonds, cherries, and/or pistachios in California’s Central Valley. Your returns are based on annual yield and quality of the nut crops every year — which depends on many factors, including the chill portion that these specialty crops receive. (A plant goes dormant in the winter during cold temperatures, and when it reaches the required number of these so-called “chill hours”, its biological alarm clock wakes up and blossoms or sets fruit. But as temperatures rise, the quality of these chill hours is affected, so agronomists calculate a number known as “chill portions” to determine if the number of hours in a narrow temperature range will enable the plant to reliably produce fruit.)

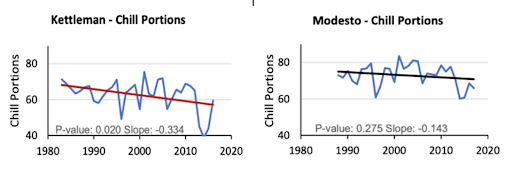

As evident from the graph, accumulated chill portions have been on a gradual decline on a decadal basis, but more importantly, the years between 2012-2017 saw a sharp decline in chill portions compared to the decade before. Therefore, modeling portfolio returns based on historical chill portions can’t be trusted in modeling future yield or expecting future portfolio returns.

Accumulation Chill portion trends in Kettleman and Modesto, California.

Source: California Office of Environment Health Assessment.

The past is no longer a predictor of the future; as climate change accelerates and variability increases, its wide-ranging shifts will pull back returns and overall productivity across the ag sector.

Investors will need more data and better estimates of the level of exposure in their portfolios (and accounting in their investment processes) to protect both their assets and returns. Data down to the granular level, such as chill portions, temperature, precipitation patterns, soil moisture, and the like is required. This information also will be crucial for performing due diligence on ongoing and future potential investment opportunities.

Myth #2: Geographic diversification is climate diversification.

Previously, investors assumed that if they spread their assets and securities around the country or even the world, they would take on less risk and their returns would be protected. However, climate change is essentially a “force majeure” that will spare no asset around the world, because each region and type of crop experiences unique impacts from climate change.

Take extreme heat, for example, a climate impact that is becoming more common and more intense. Not only does heat stress make crops wither and die, it also exhausts and can even kill farmworkers.

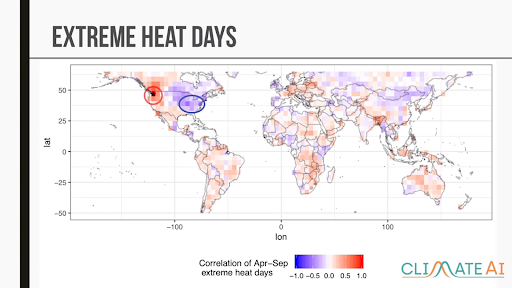

Even if you think that your portfolio is geographically diverse enough to not face too many risks from extreme heat, you might have to think again. The map below shows the observational likelihood of extreme heat days, correlated with an asset in the Pacific Northwest (circled in red).

Source: ClimateAi

You might expect other assets in the U.S. (like those in the Midwest and Northeast) to experience extreme heat when the Pacific Northwest one does — but they don’t. It’s more likely that assets in South America or those in Southeast Asia would also face extreme heat when the Pacific Northwestern one does — an unlikely conclusion for global portfolio managers.

Myth #3: Climate change is a future risk.

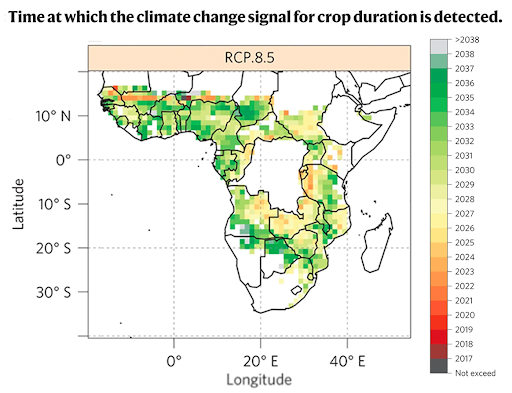

Years signaling a permanent shift in the crop duration season for Maize in Africa in RCP 8.5 (the business-as-usual climate emissions scenario). Source: Nature.

This map shows the year in which the conditions in different parts of sub-Saharan Africa will become unsuitable for African maize, given its crop duration (the length of time from planting to harvest), leading to yield loss. (The study looked at how projected heat stress and drought stress impact the duration of the crop.) As you can see, the crop duration in many parts of sub-Saharan Africa has already been exceeded, and many more will reach that point in the next decade. In fact, all other parts of Africa have that inflection point coming by 2040.

As opposed to the popular opinion that climate change is an imminent long-term issue, it has already made a permanent shift in the volatility of climate variables in places around the world. Investors will need to begin moving away from investments with material climate risks that are too great to overcome.

So what can investors do?

Investors ought to consider implementing (or improving) adaptation strategies across their portfolios. Adaptation strategies exist along three planes: seasonal decisions (is it worth planting a thirsty crop in a location that’s experiencing a drought this year?); longer-term investment decisions (can buying a more effective irrigation system generate ROI in the next five-10 years?); and transformative actions (can seed companies develop a new crop variety with greater heat tolerance and thicker stalks that will thrive in a hotter future with more storms?).

Investors will need to ensure that crop varieties and growing practices will be able to stay effective and successful in their locations, or find new ones in which they will thrive. As the world warms, certain more northern locations could open up as arable land. In addition, investing in new technologies to help reduce input costs or to help harvest could be the answer. More effective fertilizer systems, both hardware and software, can help farmers be more precise in applications and figure out when the best time of the season to apply is.

Thinking strategically on a portfolio level, as well, can help investors maintain that right balance of risk and reliability as we enter an unprecedented era of portfolio investing.

The economics of agriculture have never been easy. Climate change only threatens to make it more difficult. But understanding risks and investing in adaptation measures is crucial to ensure business continuity, not to mention securing world food production capacity in order to feed the growing population.

As Louis Bromfield said, “Agriculture is the keystone of our economic structure. The wealth, welfare, prosperity, and even the future freedom of this nation are based upon the soil.”

###

ABOUT THE AUTHOR

Himanshu Gupta, the CEO of ClimateAi, is currently creating an AI-based resilience as a service platform for enterprise supply chains starting with food and agriculture supply chains. Gupta has spent more than 14 years working in the field of climate change with both the public and private sectors. Prior to ClimateAi, Gupta worked with Vice President Al Gore and in the Government of India, leading emissions pathways work and crafting the renewable energy vision for India in the 12th five-year plan. He was in the Forbes 30 under 30 India list of 2016 for his contributions to the climate change space in India. He has been published and quoted by WSJ, FT, Business Insider, MIT Technology Review, Business Standard, Stanford Social Innovation Review, among other publications, and has co-authored a book on India’s low carbon economy. Gupta earned his MBA/MS in an environmental engineering dual-degree program at Stanford University.

*All views, data, opinions and declarations expressed are solely those of the author(s) and not of Global AgInvesting, GAI News, or parent company HighQuest Group.

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.