February 19, 2020

By Catherine Bowlus and Artem Milinchuk, Business Strategy Associate and CEO/Founder, FarmTogether

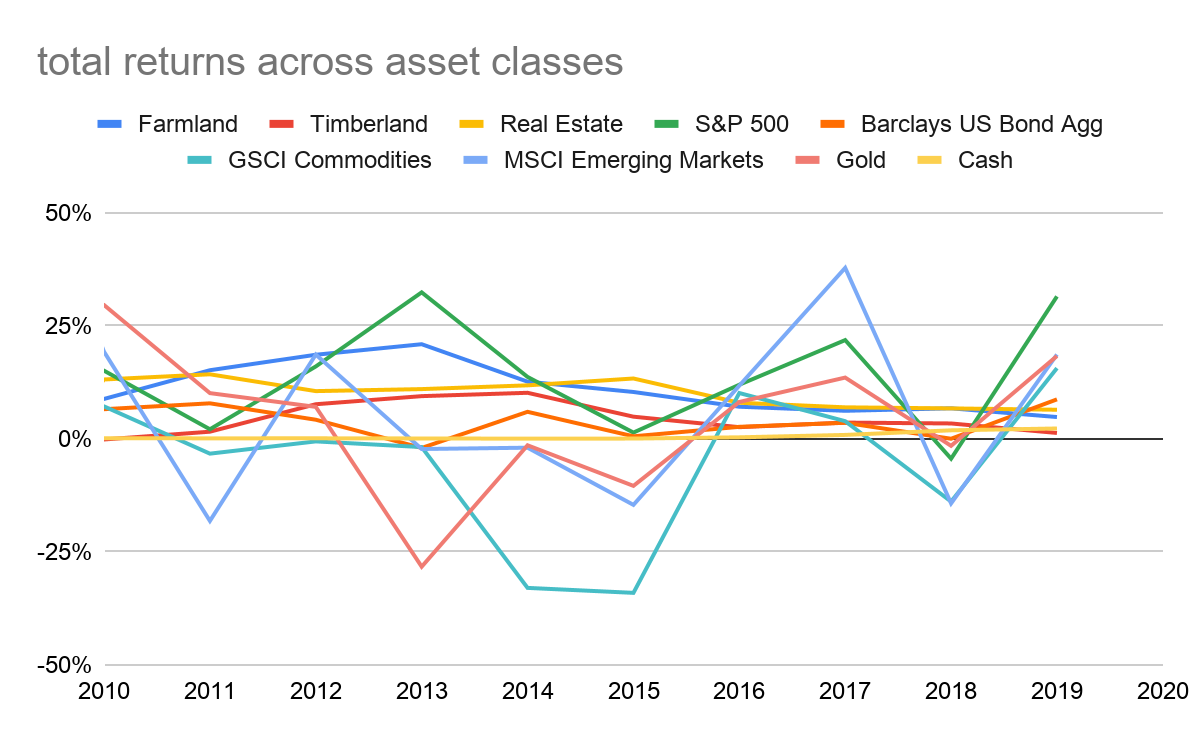

Farmland has outperformed all major asset classes over the last decade aside from stocks and conventional real estate. One hundred dollars invested in farmland on January 1, 2010 would now be worth over $280, with U.S. stocks coming in just above $350, however, with much more volatility (12.6 percent volatility for the S&P 500 versus 6.1 percent for farmland).

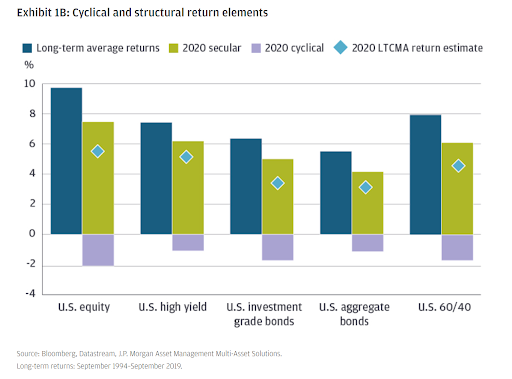

Twenty-nineteen proved to be a good year for investors who were heavily weighted in stocks. However, with major financial institutions(1) expecting performance in the 3-9 percent range for most asset classes, especially given the strong run-up the S&P 500 posted in 2019, it’s unlikely that trend will continue.

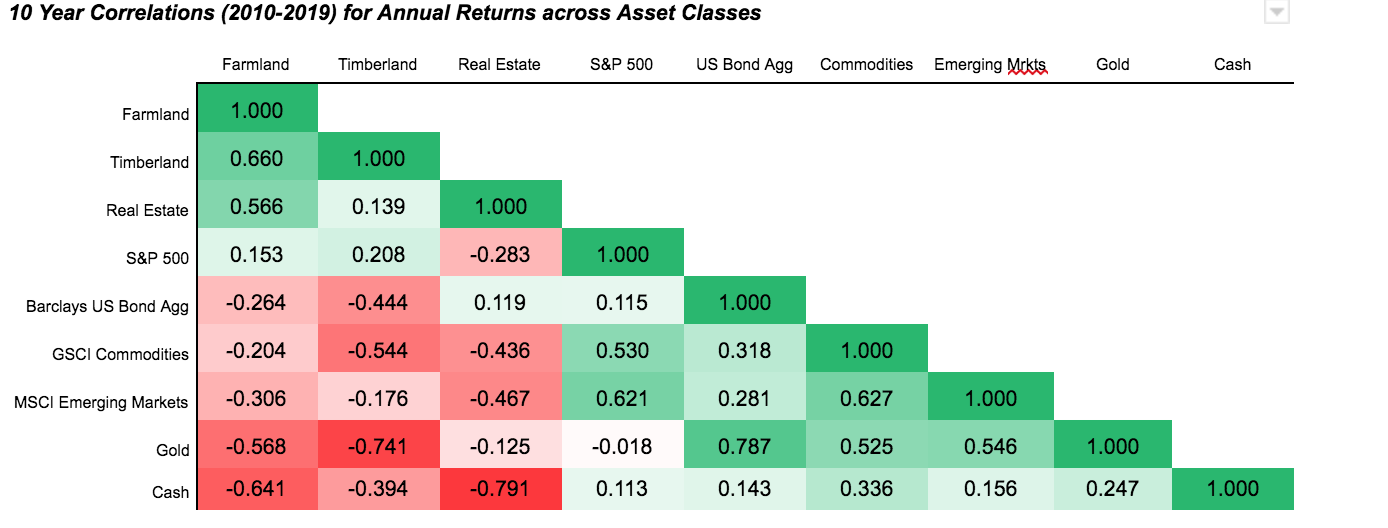

JPMorgan’s outlook specifically highlights how, “real assets remain an attractive source of both returns and diversification.” Similar to conventional real estate, farmland returns have historically been largely uncorrelated with other asset classes, offering diversification to most portfolios.

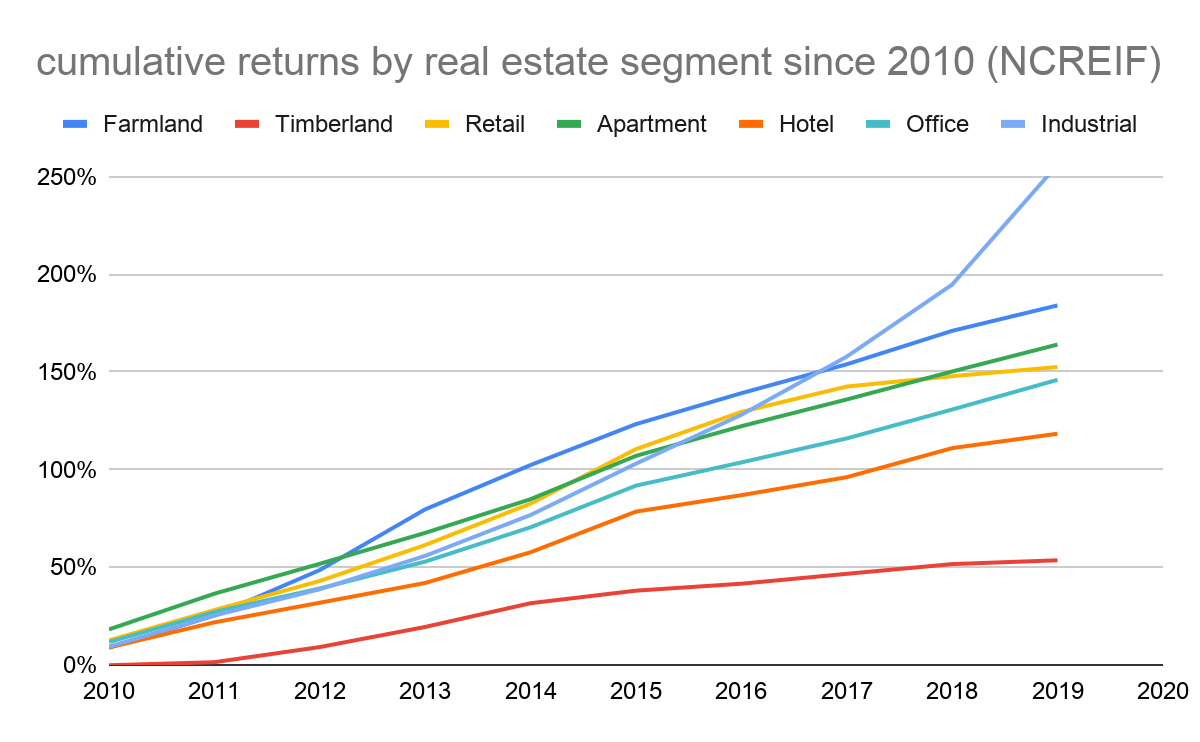

Looking across real estate segments for the last 10 years, farmland has outperformed most segments. Industrials experienced the most growth driven by demand for warehousing space as consumers increasingly switch to online retail, though this squeezed cap rates in the process. According to the USDA’s reporting, farmland acreage has fallen by more than 1.5 percent in the last decade while land values and rents continue to rise. With population growth continuing to drive demand for crops, we’d expect farmland returns from both appreciation and rental income to continue on an upward trajectory.

We thus believe that farmland remains competitive both on an absolute and a relative return basis, and especially on a risk-adjusted basis. Still a largely untapped asset class with little investor competition, we see boundless opportunities for alpha in this market, especially when applying our constantly improving tech-driven underwriting lens.

>>>

(1) For example: Morgan Stanley, JPMorgan, UBS, Blackrock, Vanguard, Barings

DISCLAIMER

All views, data, opinions and declarations expressed are solely those of the author(s) and not of Global AgInvesting, GAI News, GAI Gazette, or parent company HighQuest Partners.

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.