November 7, 2018

This article will be featured along with other articles addressing investment opportunities in European agriculture in Volume 5, Issue 4 of the GAI Gazette, which will be distributed in conjunction with Global AgInvesting Europe 2018, held in London on 4-5 December 2018. Join us in London to hear valuable insight and best practices for investment strategy from the expert speaking faculty. Learn more and register.

By Kieran Furlong & Arama Kukutai, Finistere Ventures

When European farmers wake up in the morning, they face an array of challenges in the day ahead of them. Many of these are common to farmers across the world – weather, disease pressure, availability of labor, and so on. In addition, however, farmers in Europe have unique challenges due to the complexity of the European Union and national governance of agriculture.

Core European Agtech Challenges

Decades of farm production quotas and the Common Agricultural Policy have distorted markets and arguably limited innovation and efficiency drivers while creating dependency on subsidies for the majority of farmers in the EU. European public sentiment and governmental policy have eliminated certain technologies as options for farmers, making investment in fields like biotech a tougher proposition. A relatively wealthy and educated population makes increasing demands on food producers in terms of environmental performance, food safety and quality, transparency, and of course, cost, which impacts farmer incomes.

It is in this context that agtech investors like Finistere are asking: “How can new technologies help European farmers tackle these challenges, profitably, and sustainably?” Agtech companies can’t just focus on making a farm 10 percent more productive if the current farming practices are prevented by new regulations or there simply isn’t anyone to work on the farm. This is an existential challenge for European farmers as well as an economic one.

Environmental Concerns

For a variety of cultural and historical reasons, the environment tends to be a higher profile issue for European consumers and voters than in other regions. Increasingly, this is having a real impact on European agriculture. In June of this year, the European Court of Justice ruled against Germany, stating that its government had not taken sufficient measures to prevent nitrate pollution of groundwater by agriculture. Meanwhile, Dutch dairy farmers have been on a rollercoaster ride since the end of EU milk production quotas in 2015. An initial burst of herd and production increases since 2015 has been followed by swinging culls of the national dairy herd – directed from Brussels – due to excessive phosphate levels in the soil. At risk is the Dutch nitrate derogation, which is said to be worth around one billion euro to the national dairy industry.

Another example, Ireland – a major dairy producer that has seen huge growth since the end of quotas – is seeking to avoid the negative impact of overuse of fertilizers seen in pastoral producers like New Zealand. Many dairy farmers in Ireland also operate under nitrate derogations. The challenge of nutrient management is a clear opportunity for new technology to offer solutions. Ideally, nutrients should only leave a farm as produce – crops, milk, meat, and so on. If nutrients leave a farm as pollutants, this creates both damage to the environment and a direct economic loss to the farmer.

CropX (a Finistere portfolio company) is bringing its “Internet of Soil” technology solution to this problem. The Israeli company first addressed the need for smarter irrigation in parts of the world like the western U.S. and Australia. However, it is currently exploring a huge opportunity in Europe to provide better nutrient management on farms. Its farm IoT platform allows producers to measure and address better management of fertilizers and slurry nutrients, giving farmers increased output while also improving water quality. CropX sees Ireland as an ideal entry market to deploy the technology, before rolling its nutrient management solution out across the EU.

Government Support

This type of “two-for-one” benefit is exactly what the EU Commissioner for Agriculture, Phil Hogan, is calling for in European agriculture. European governments have set high bars for environmental performance, and they are under pressure to deliver on those promises. At the same time, the need for reform of the Common Agricultural Policy and how the EU supports its farmers has never been greater given the cost is 70 billion euro. The eastward expansion of the union since 2004 and the seismic shock of the Brexit vote in 2016 have created conditions in which there is no option other than to change the CAP.

EU leaders see an opportunity to tie improvements in environmental performance to support for farming. In a high-profile speech at the Forum for the Future of Agriculture 2018 in Brussels, Commissioner Hogan declared: “Simply scaling down production to reduce emissions is not the right option in times of growing global food demand. Measures that mitigate climate change and increase resilience without undermining production potential should therefore be prioritised and encouraged. The role of new technologies and precision agriculture will be central to delivering this win-win outcome.”

Further constraints affect European farmers through regulations on existing tools and effective prohibitions on new ones. Conventional crop protection products such as glyphosates (herbicide) and neonicotinoids (insecticides) have been at the center of intense debates involving policy-makers, NGOs, and farming groups. After much high-profile wrangling, the EU voted in November 2017 to extend the glyphosate license for five more years. However, some see this as a mere stay-of-execution. This provides an opportunity for startups developing novel technologies for tackling weeds and crop protection.

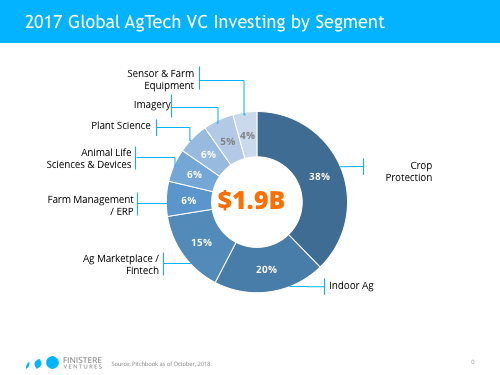

Finistere’s research with PitchBook identified that nearly 38 percent of the US$1.9 billion investment in agtech has been in some form of crop protection tech including biologicals. Investment in the EU is strong in these areas, especially with research in microbiome (such as in the Belgium, Ireland, and the Netherlands), but other methods of tackling the problem of competitive weeds also are in development. Prime examples include robotic weeding machines (Ecorobotix) and non-chemical means of killing weeds (Rootwave).

New technologies that can aid farmers in other ways also face obstacles in Europe. Genetically modified crops have been held back at the gates for decades, driving large multi-billion R&D budgets into North America. While many agricultural researchers saw a glimmer of hope in Europe for gene editing with the new CRISPR/CAS9 toolkit, that door has been slammed shut following the European Court of Justice’s ruling that “the GMO Directive is also applicable to organisms obtained by mutagenesis techniques [including CRISPR/Cas9 gene editing] that have emerged since its adoption.” While this verdict was disappointing to investors in gene-editing agtech startups, it provides incentives for other technologies that will gain a social license in Europe. This may include novel methods to accelerate conventional crop breeding, but also new seed treatment and crop enhancement products.

On-Farm Ramifications

One of the effects (and in fact, intentions) of EU agricultural policy was the perseverance of smaller, family-owned farms. The consolidation into ever-larger farms and higher efficiency production has thus been held back in Europe compared to other regions. This brings disadvantages when trading in a global commodity market based on minimum specifications and low prices. However, there are potential advantages to the European farming structure that can be exploited through the application of technology.

With absolute caloric load in the West becoming less important than quality and health trends, there is an ever-growing cohort of consumers who are prepared to pay more for qualities they care about. These buzzword qualities include organic, local, seasonal, heritage, ethically raised, farm-to-fork, conservation grade, and so on. “Everything will not be about prices in the future,” as one senior executive from the Coop Denmark put it.1 It is easy for detractors from the large-volume, conventional agrifood industry to belittle such labeling. However, one can imagine senior executives in the global brewing giants made similar noises about microbreweries back in the 1980s and 1990s. Fast forward a few decades, and craft brewers have successfully “decommoditized” the U.S. beer market. There is now huge choice and a variety of pricing driven in part by artisanal hops varieties and maltings.

Farmers are more exposed, but also better able to link to the supply chain – to reach the consumers who care about the qualities those farms can deliver and the companies who serve them. The pressure being experienced by mainstream CPG companies to deliver new consumer experience and value is an important opportunity for farmers in the EU and one for which risk capital is available.

To stay ahead of these consumer-driven trends, smart farmers are working with innovative product companies that are using verified certification processes, as well as marketing on trends such as local and sustainable production. The best farmers in Europe believe they are producing the highest quality products and deserve to be paid for that. Technology will allow them to put that assumption to the test and reach the consumers who care. We are moving into an era when Customer Supported Agriculture (CSA) will be much, much easier to do. Online marketplaces are cropping up to connect consumers and farmers, and a new range of supply chain technologies focusing on verification (including blockchain) is being deployed. A prime example: Walmart and IBM announced a new partnership in this area recently.

At a recent dairy industry conference, the hot discussion focused on the future being full transparency. The outside world no longer stops at the farm gate or the abattoir door. It is easier and easier for consumers and interest groups to test what is on the shelves and “look through” the supply chain. Some players in the industry will view this as a threat. It has proven so for some in recent years (horsemeat in beef burgers, melamine in infant formula, etc.). Animal-rights activists are flying drone cameras over feedlots. Consumer protection groups are testing food product for residual crop protection chemicals. There is an opportunity for European farmers who believe they are doing the right thing and making superior products to use technology to prove it to the world and gain customers as a result.

However, another major challenge facing European farmers is the availability of labor. For many, this isn’t simply a matter of having to pay more; there just aren’t enough willing employees available at any price. We recently spoke to a senior executive of a large milking equipment manufacturer, and he said this is what is driving the adoption of milking robots in Germany and Scandinavian countries. It’s not about incremental efficiency gains, but about an existential need in the face of no workers and unwilling family successors. For the latter group, how to make farming an attractive lifestyle for people in the 21st century is a huge challenge, but another one that technology can address.

The Internet of Things (IoT) stands to be a ubiquitous feature of the connected farm in the near future. We estimate over 400 startups since 2013 have been created focusing on digital and smart farming technologies. This is a global trend across all farming types, though adoption is progressing at very different rates between regions. In the EU, there is a strong cohort of IoT in ag, ranging from dairy and livestock to sensor and robotics tech. We expect to see a continued maturation of this field in EU farming life.

Farm labor is likely to be an even tougher problem for UK farmers post-Brexit. Given that immigration has been a flash-point in the whole Brexit debate, the UK government and farmers will have a significant challenge in finding farm laborers. A recent Economist article pointed out that 53 percent of UK farms need subsidies to be economically viable.2 While new trade deals may allow cheaper food imports from other parts of the world, if the British population wish to maintain their “green and pleasant land,” they will have to pay to support their farmers.

Farmers will have to live up to those expectations by utilizing some of the technologies mentioned above. Sitting outside the EU may allow new technologies like gene editing to gain a foothold in the UK. However, given that acceptance of such technology is driven as much by public sentiment as by hard regulation from the EU, it remains to be seen how far UK consumers will drift from their erstwhile colleagues across the Channel.

Agtech Advancement

Farming in Europe is different from farming in other regions of the globe, and agtech is evolving in diverse ways across the EU. As the second largest investment recipient after the U.S., the EU is leveraging technology clusters and investment from other sectors while drawing in new talent. As a prominent example, Ireland is a hotbed for agtech R&D and early stage startups. Entrepreneurs, engineers, and scientists in Ireland are leveraging domain expertise and applying it in a knowledgeable manner to real farming problems based on their multi-generational farming roots. Traditionally, the agrifood sector has provided most of Ireland’s exports (valued at around 12 billion euro per year) but has been surpassed in recent years by IT, biotech/pharma and medtech. By combining the knowledge and skills from all those sectors, a thriving agtech scene is evolving.

Among other European countries, there is a stark contrast in the approach to agtech, with France undoubtedly taking the lead for “large” European countries when it comes to agtech activity. Perhaps the place the French farmer occupies in the French imagination (and the streets of Paris every so often) plays a role, along with a national obsession with quality food. As additional agtech centers take root throughout Europe, it will be interesting to watch the trends and new technologies that emerge.

At the root of it all is the European consumer. As European consumers care deeply about other factors – alongside price – they are encouraging a special crop of agtech players. With the adoption of new technologies, European farmers may be able to turn perceived weaknesses into qualities that the world will clamor for in the years ahead. Labor-saving and efficiency technologies can help relieve the burden on European taxpayers, who want to support their stewards of the land. And those same stewards can do a much better job of protecting the environment with the adoption of new technologies.

ABOUT THE AUTHORS

Arama Kukutai is a co-founder and partner at Finistere Ventures, with over 20 years’ experience as an entrepreneur and founder in the agribusiness sector. He served as executive chairman of PKW Farms, a successful agribusiness and diversified investment entity involved in dairy farming and aquaculture activities in New Zealand, Asia, and Australia. Kukutai also led the New Zealand government’s Trade & Investment agency in North America, following which he emigrated to the U.S. He has led the creation of Finistere’s global network in agtech, which includes offices in Tel Aviv, San Diego and Silicon Valley, and Dublin, Ireland. Kukutai serves on the boards as a director or observer of current portfolio companies AgGenetics, Biolumic, Crop Pro Insurance, CropX, Hi Fidelity Genetics, Plenty, Taranis and Zeakal. Kukutai holds law and agronomy degrees from the Victoria University of Wellington (NZ). He can be reached at akukutai@finistere.com.

Arama Kukutai is a co-founder and partner at Finistere Ventures, with over 20 years’ experience as an entrepreneur and founder in the agribusiness sector. He served as executive chairman of PKW Farms, a successful agribusiness and diversified investment entity involved in dairy farming and aquaculture activities in New Zealand, Asia, and Australia. Kukutai also led the New Zealand government’s Trade & Investment agency in North America, following which he emigrated to the U.S. He has led the creation of Finistere’s global network in agtech, which includes offices in Tel Aviv, San Diego and Silicon Valley, and Dublin, Ireland. Kukutai serves on the boards as a director or observer of current portfolio companies AgGenetics, Biolumic, Crop Pro Insurance, CropX, Hi Fidelity Genetics, Plenty, Taranis and Zeakal. Kukutai holds law and agronomy degrees from the Victoria University of Wellington (NZ). He can be reached at akukutai@finistere.com.

Kieran Furlong heads the Finistere Ventures E.U. office based in Dublin, Ireland. In addition to his activities in Ireland and the rest of Europe, he is focused on the application of biologicals in crop protection and animal health. Furlong brings a wealth of international experience from large chemicals companies and biotech/cleantech start-ups to the Finistere team. He started his career in the global chemical industry at ICI and Johnson Matthey where he worked closely with major agribusiness customers such as Cargill, ADM, and Bunge.

Kieran Furlong heads the Finistere Ventures E.U. office based in Dublin, Ireland. In addition to his activities in Ireland and the rest of Europe, he is focused on the application of biologicals in crop protection and animal health. Furlong brings a wealth of international experience from large chemicals companies and biotech/cleantech start-ups to the Finistere team. He started his career in the global chemical industry at ICI and Johnson Matthey where he worked closely with major agribusiness customers such as Cargill, ADM, and Bunge.

Following his career in the chemical industry, Furlong entered the world of start-ups. He first worked at Solzyme – an algae biotechnology company – and then led the business development activities at Virent, including a successful partnership with The Coca-Cola Company in the development of a 100 percent bio-based PET bottle. He has now turned his attention to the application of biotechnology in agriculture.

A native of Ireland, Furlong recently returned to his home country following 20 years overseas in the U.S., Germany, the UK, and Argentina. He holds a degree in chemical engineering from University College Dublin, Ireland, and an MBA from the Graduate School of Business at Stanford University where he was an Arjay Millar Scholar. Furlong can be reached at

kfurlong@finistere.com.

# # #

DISCLAIMER: All views, data, opinions and declarations expressed are solely those of the author(s) and not of Global AgInvesting, GAI News, GAI Gazette, or parent company HighQuest Group.

1. Voinea, Anca “Coop Denmark Blazes Trail on Organic Food”. Coop News. May 7, 2015. https://www.thenews.coop/93434/sector/retail/coop-denmark-blazes-trail-on-organic-food/↩

2. “How Brexit Could Change the Face of Rural Britain”. The Economist. August 30, 2018. https://www.economist.com/britain/2018/08/30/how-brexit-could-change-the-face-of-rural-britain↩

Let GAI News inform your engagement in the agriculture sector.

GAI News provides crucial and timely news and insight to help you stay ahead of critical agricultural trends through free delivery of two weekly newsletters, Ag Investing Weekly and AgTech Intel.